Colorado Legislators Approve $1 Billion in Tax Breaks Amidst TABOR Refund Concerns

Chief Economist Warns of Fiscal Risks as Colorado Faces Budget Shortfall

According to AXIOS DENVER, in a significant move, Colorado legislators have approved $1 billion in new tax breaks marking a substantial shift that could potentially eliminate taxpayer refunds under the state’s Taxpayer’s Bill of Rights (TABOR). This decision finalized during the recent legislative session introduces 26 new tax credits aimed at benefiting specific groups including parents older homeowners freight rail operators, and the film industry. These tax breaks are designed to redirect funds that would have otherwise contributed to TABOR refunds projected to reduce these refunds by approximately $3 billion over the next three fiscal years according to recent economic forecasts.

Greg Sobetski Chief Legislative Economist has underscored the significant impact of these tax credits on Colorado’s revenue stream. He characterized the reductions as enormous warning that they could pose heightened risks to the state’s fiscal stability in the years ahead. This fiscal realignment has already raised concerns among lawmakers, particularly with a projected $164 million shortfall in the current budget cycle. The shortfall has prompted scrutiny over Colorado’s financial reserves which currently stand below the required 15% reserve mandated by state law. Republican Sen. Barbara Kirkmeyer of Weld County has been vocal in her criticism labeling the situation as irresponsible and attributing it to what she views as excessive spending by Democratic legislators during the session.

READ ALSO: Hamilton’s Old Hotel Gets Big Boost From Ohio Government

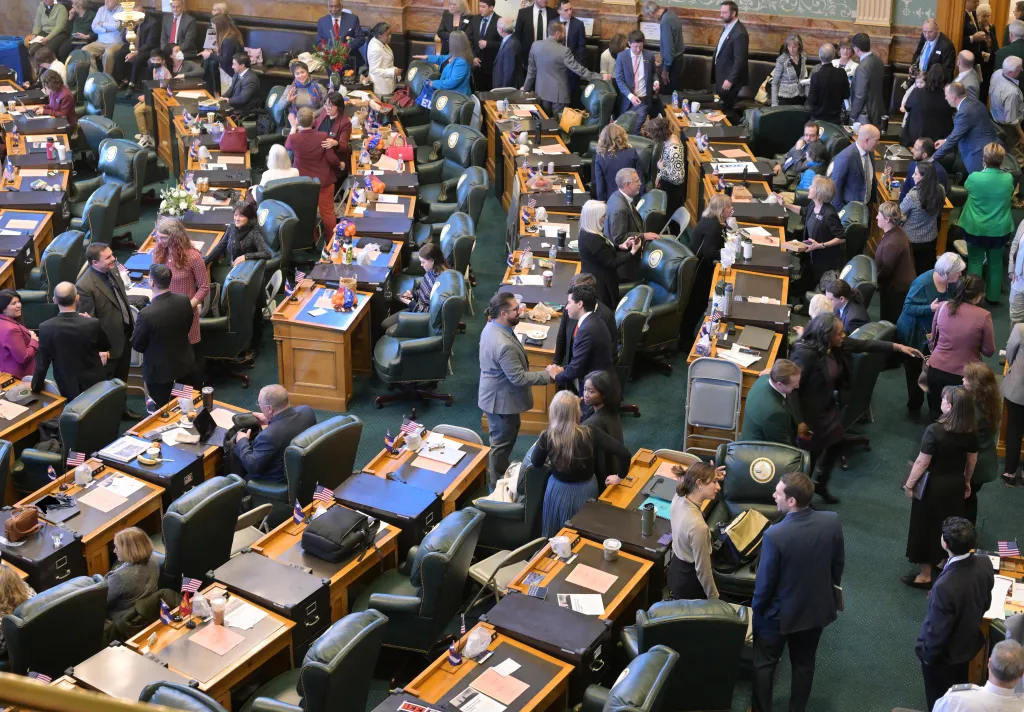

$1 Billion Shift: Colorado Lawmakers Prioritize Tax Credits Over TABOR Refunds, Sparking Fiscal Concerns! (PHOTO: The Denver Post)

Democratic Lawmakers Defend Tax Credits Despite Criticism

Despite criticisms Democratic lawmakers who hold a majority in Colorado’s legislature have staunchly defended their decision to prioritize these tax credits. They argue that these measures are essential for supporting their policy priorities such as economic stimulus and targeted social support initiatives. Democrats contend that while these tax breaks may curtail TABOR refunds they are necessary to address specific needs and promote equitable economic growth across the state. This strategic shift reflects a broader ideological debate over the role of government spending and tax policy in shaping Colorado’s economic trajectory emphasizing competing priorities between fiscal responsibility and targeted investment.

READ ALSO: 8.51 Million UK Pensioners Hit With “Stealth Tax” As 1.66 Million More Pay Income Tax On State Pensions!

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)