Navigating Retirement Taxes: Strategies to Minimize Social Security Tax Burdens in Taxing States

Understanding State Tax Laws: Relief Options for Social Security Taxation in Tax-Imposing States

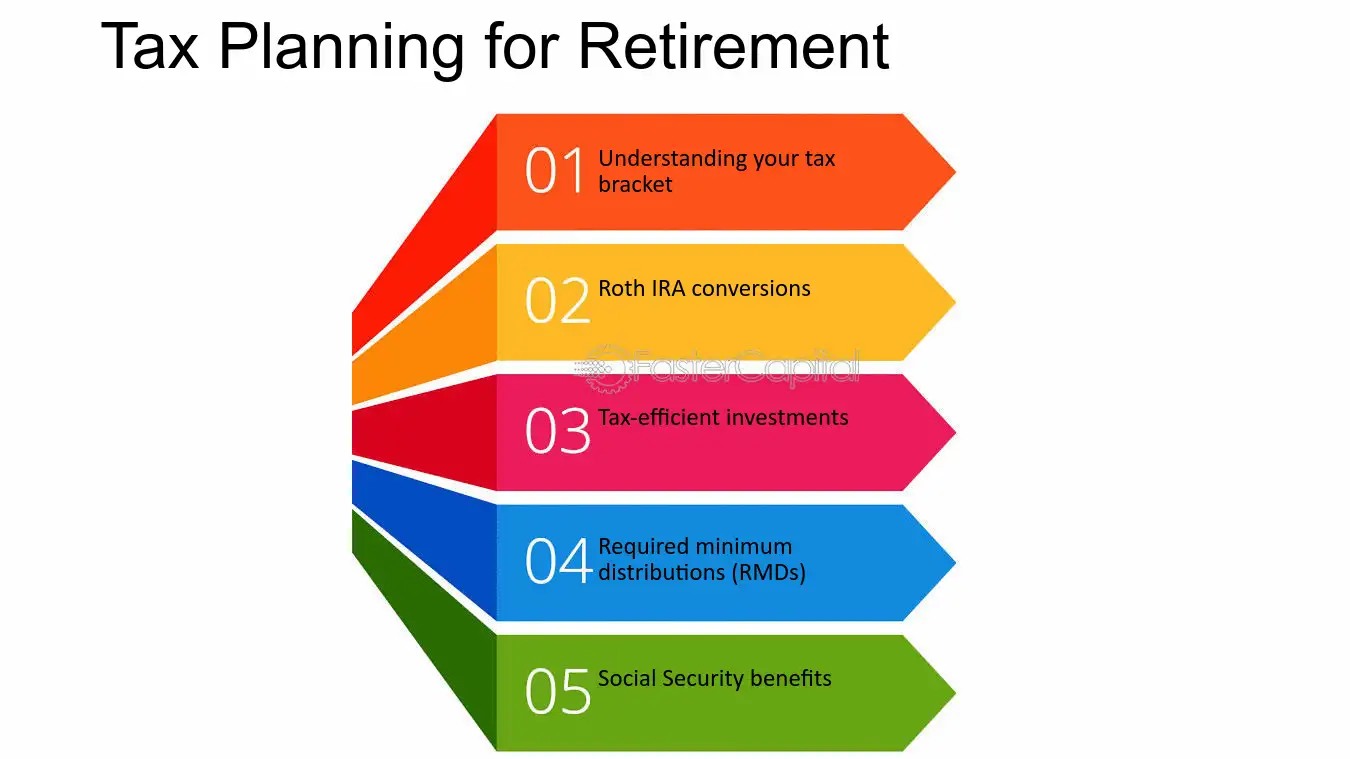

According to Fool, According to Fool, Retirement planning involves navigating complex tax implications, particularly regarding Social Security benefits. While Social Security constitutes a significant portion of retirees’ income, it’s reassuring to note that only 10 states levy taxes on these benefits. Moreover, even within tax-imposing states, there are often avenues for tax relief, especially for older individuals or those with lower incomes.

If you live in one of the states where Social Security benefits are taxed, it’s important to learn about the rules and exceptions in your state. Some states, like Colorado, Vermont, and New Mexico, give breaks to certain people based on things like how old they are or how much money they make. And even though the federal government taxes Social Security benefits for some retirees, there are strategies you can use, like deciding when to start collecting benefits, to try to lower your overall tax bill.

(PHOTO: GOOGLE)

Comprehensive Retirement Planning: Beyond Social Security Taxes to Property and Sales Taxes

As you prepare for retirement, it’s crucial to consider a broad spectrum of taxes beyond just those related to Social Security. Property taxes and sales taxes, which fluctuate based on your location, should also be factored into your financial planning. Additionally, maximizing your Social Security benefits is essential for ensuring a stable financial future during retirement.

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)