Refund Arrival Times Vary Depending on the Filing Method for Oklahoma Taxpayers

Taxpayers Advised to Utilize Online Tools or In-Person Support for Refund Tracking

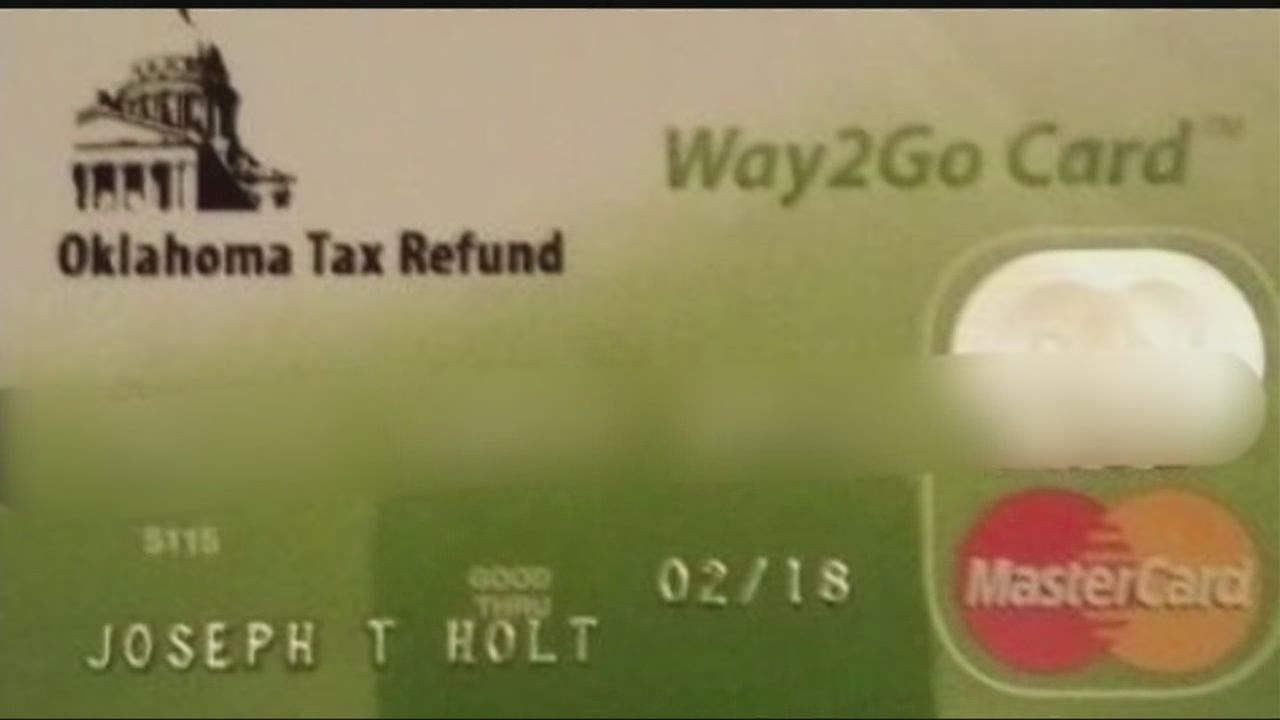

Oklahoman taxpayers look forward to receiving their state tax refunds, which will arrive in different amounts based on how their forms were filed. Based on the article published by The Oklahoman, The Oklahoma Tax Commission expects that refunds for online filers who choose direct deposit will arrive in five to six weeks, while postal filers who choose direct deposit may have to wait ten to twelve weeks. For individuals who opt for debit card reimbursements, the procedure takes a little longer between six and thirteen weeks. The Commission recommends that taxpayers track their refunds and get help through the state’s Taxpayer Access Point. They can do this online or by making in-person appointments at the Taxpayer Resource Center located in Oklahoma City.

(PHOTO: KSWO)

The IRS guarantees prompt federal refunds, offers a tracking tool, and offers options for extending the tax deadline

For federal tax refunds, on the other hand, the IRS guarantees taxpayers that, assuming the return is error-free, refunds are normally given out 21 days after filing. The “Where’s My Refund?” option on the IRS website allows taxpayers to keep track of the progress of their federal refunds. People are reminded that they have until April 15 to complete their tax returns for both federal and Oklahoma state income taxes. By using Form 4868, they can request an extension, giving them an extra six months to finish their returns. Taxpayers should be aware that they could be penalized for filing after the deadline without getting an extension, particularly if they owe money on taxes.

READ ALSO: Council Tax Rebate For Private Renters: A Proposal To Encourage Homeownership

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)