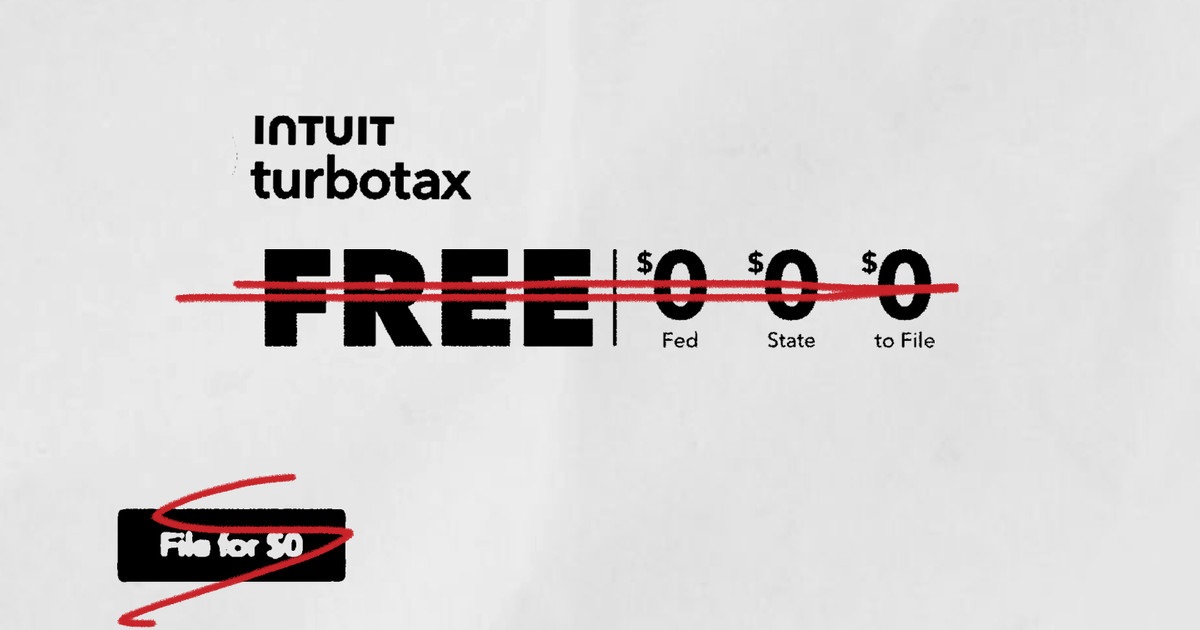

Federal Trade Commission Issued Final Order Against Intuit For their Deceptive Free Advertisement (Photo: BNN Bloomberg)

Federal Trade Commission Orders Intuit to Address Deceptive Advertising

In a final order, the Federal Trade Commission (FTC) has imposed a final order on Intuit, the manufacturer of TurboTax, on the grounds of deceptive advertising and misrepresenting the availability of “free” tax products and services to consumers. The order aims to prevent Intuit from marketing anything as free unless it is genuinely accessible to all consumers, or unless it discloses the percentage of consumers who qualify for the free product. Examples of ineligible taxpayers include those claiming mortgage and property deductions, charitable donations over $300, and gig workers reporting income as independent contractors. The FTC’s action sends a strong message that “free” must mean free for all, not just a select few.

So, how much does TurboTax actually cost? The only truly free option is for simple returns without added tax complexity. TurboTax Deluxe, suitable for homeowners and maximizing deductions, costs $39 for both federal and state taxes. If your taxes involve investment and rental properties, the TurboTax Premier version is priced at $89 for federal taxes and an additional $39 for state taxes. Freelancers and self-employed individuals should opt for the TurboTax Premium for Self-Employed option, which costs $89 for federal taxes and an additional $39 for state taxes.

This isn’t the first time Intuit has faced scrutiny. The FTC had previously sued Intuit for deceiving consumers with false claims of “free” tax filing. The company’s misleading advertisements had targeted millions of consumers who ultimately did not qualify for the free services, leading to a $141 million multi-state settlement for deceiving low-income Americans into paying for tax services that should have been free.

READ ALSO: West Virginia Proposes Photo ID Requirement For Food Stamp Purchases Amid Increasing SNAP Benefit Fraud

FTC’s Legal Action Against Intuit Emphasizes the Importance of Honest Advertising and Consumer Awareness

As NBC Los Angeles reported, Intuit reached a substantial settlement and halted its “free, free, free” advertising campaign in response to an investigation conducted by New York Attorney General Letitia James. This action symbolizes the severe repercussions that companies may incur for engaging in deceptive practices, and represents a turning point in the realms of advertising ethics and consumer protection. Hence, to promote transparency and equity, it is imperative that individuals possess knowledge regarding the true expenses associated with tax services and thoroughly examine any assertions regarding “free” offerings.

The FTC’s action against Intuit highlights the need for clear and honest advertising, especially in crucial financial matters such as tax services. Consumers should be vigilant in understanding the true costs involved in tax software and services to make informed decisions. The era of misleading “free” claims must come to an end, with companies held accountable for their marketing practices and commitments to consumers.

READ ALSO: Mark Zuckerberg’s Secretive Multi-Million Dollar Hawaiian Project Unveiled: A Blend Of Luxury And Survivalism

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)