Consumer Debt Relief Services: Promising to Ease the Burden, but Falling Short

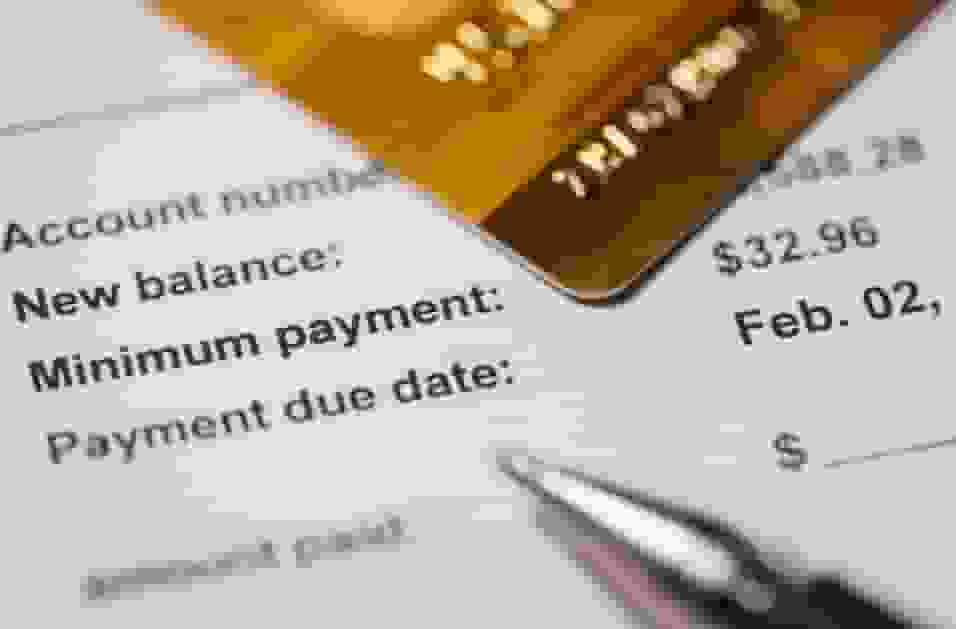

As U.S. consumer debt skyrockets to unprecedented levels, individuals seeking relief from mounting monthly payments and interest are increasingly drawn to debt consolidation and repair companies in an effort to ease the burden of their financial woes. (Photo: gettyimages)

The Pitfalls of Debt Relief Services: Promising to Ease the Burden, but Falling Short

According to source, as consumer debt in the United States soars to record levels, individuals facing the weight of mounting monthly payments and interest are increasingly turning to debt consolidation and repair companies to ease their financial burden. However, a recent study by the Better Business Bureau (BBB) reveals that these companies often overpromise and underdeliver in their efforts to ease the burden. While they advertise quick and comprehensive solutions for improving credit scores and managing overdue bills to ease the burden, their capacity to effect substantial change is limited.

Additionally, almost half of consumers who enrolled in their settlement plans dropped out before completing payments, exacerbating the challenge of easing their financial burdens. Student loan borrowers, already burdened by financial stress, are especially susceptible to scams that promise to ease the burden. Fraudsters offer to negotiate lower debt payments or consolidate loans, resembling legitimate debt and credit assistance companies aimed at easing the burden. Many of these scams demand upfront fees or personal information, further complicating efforts to ease the burden of financial stress.

With student loan repayments resuming in October, the Federal Trade Commission (FTC) and BBB have warned against student loan forgiveness scams, urging consumers to remain cautious and avoid scams that exacerbate the burden.

READ ALSO: Stimulus Checks and Child Tax Credit, Will Americans Receive New Aids?

Empowering Financial Freedom: DIY Solutions to Ease the Burden of Debt and Credit Woes

Fortunately, consumers have the option to address debt and credit issues without resorting to costly services that may not effectively ease the burden. Implementing DIY credit repair involves budgeting, negotiating with creditors, seeking mortgage and auto loan solutions, and contacting credit card companies for assistance to ease the burden.

For those choosing credit counseling, be cautious of upfront fees and ensure payments are made only after services are rendered, allowing individuals to take control of their financial situations and effectively ease their burdens without relying on services that may not alleviate the burden as expected.

READ ALSO: SNAP Benefits: Does Your State Participate in the Restaurant Meals Program?

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)