The Senate Finance Committee’s new bill is announced to help renters be eligible for credit.

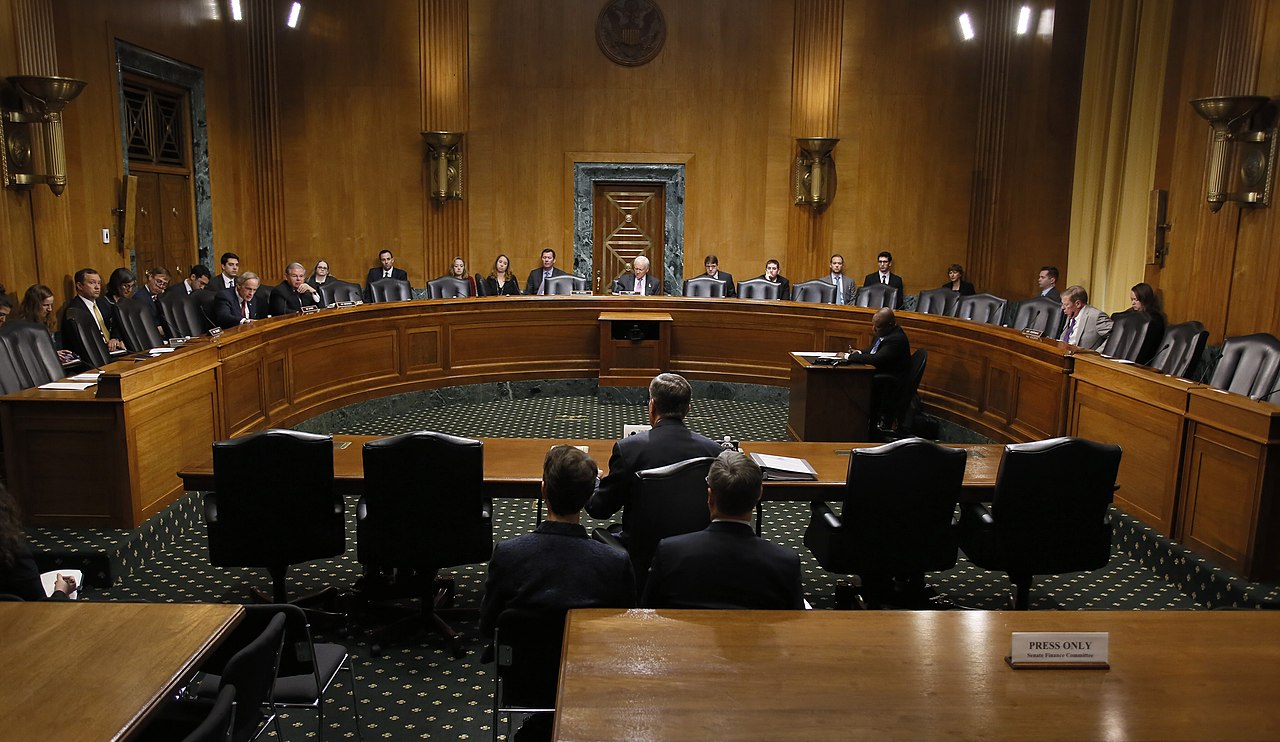

This new bill by the Senate Finance Committee is also announced to be implemented from 2024 through 2026. (Photo: JURIST)

Bill By The Senate Finance Committee

The Senate Finance Committee approved a bill that will provide tax credits to renters who meet certain qualifications. The approved bill by the Senate Finance Committee is called SB24-146.

This approved bill by the Senate Finance Committee creates an income tax credit for income-qualified renters for the years 2024 through 2026. To qualify for the said bill by the Senate Finance Committee, renters must have a federal adjusted gross income of $75,000 or less for single filers or $150,000 or less for joint filers and rent a primary residence in Colorado.

The tax credit amount from the approved bill by the Senate Finance Committee will vary based on income, with a maximum of $2,000 for joint filers with AGIs of $50,000 or less and $1,000 for single filers with AGIs of $25,000 or less.

According to a published article by SmartNews, the credit approved by the Senate Finance Committee, however, will decrease for higher incomes. The approved bill by the Senate Finance Committee also does not affect eligibility for other assistance programs and aims to help those struggling with the high cost of housing in Colorado.

A Nonrefundable Tax Credit

In a published article by the Colorado General Assembly, a nonrefundable income tax credit is created for taxpayers who rent their primary residence in the state and have a federal adjusted gross income below certain thresholds. The credit amount varies based on filing status and income level.

READ ALSO: Two Payments Of Social Security May Be Received By Some Americans Due To Coinciding Payment Dates

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)