On June 30, the Supreme Court made a significant decision that denied forgiveness of $430 billion in federal student loan balances for 20 million borrowers. This ruling also affected another 23 million borrowers which prompted Biden’s plan to address the problems of the borrowers.

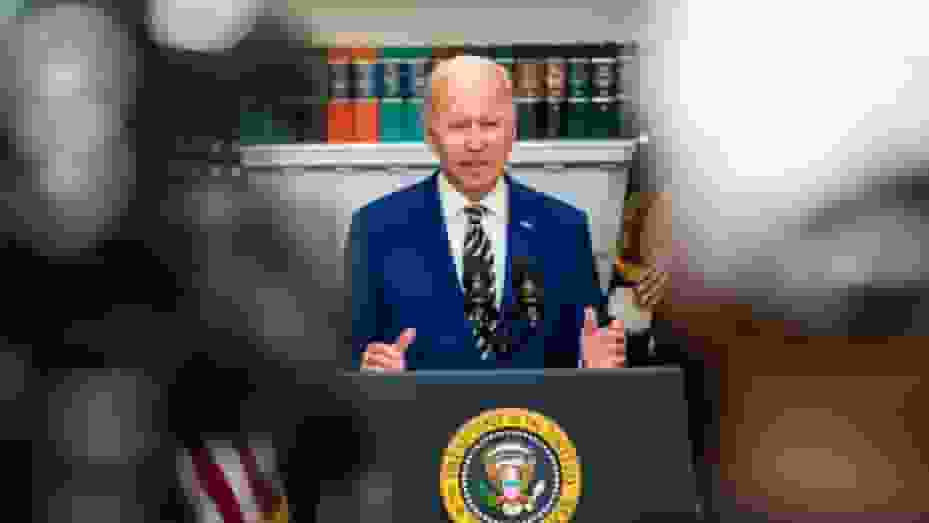

Supreme Court’s ruling also affected another 23 million borrowers which prompted Biden’s plan to address the problems of the borrowers. (Photo: Reuters)

Biden’s Plan After Supreme Court Rejects Student Debt Cancellation

In response to the Supreme Court’s rejection of student loan forgiveness on June 30, Education Secretary Miguel Cardona announced Biden’s plan to address student loan debt before July 1, 2024, when new borrower regulations will come into full effect, a published news article reported.

Secretary Cardona unveiled the Saving on A Valuable Education (SAVE) plan as the most affordable repayment plan in history. This plan aims to reduce monthly payments to zero dollars for low-income borrowers, saving other borrowers at least $1,000 per year and curbing excessive interest accumulation that leaves borrowers owing more than their initial loan amount.

Under SAVE, borrowers who enroll in the plan and fulfill their payment obligations will no longer see their loans grow due to unpaid interest.

Approximately 70% of borrowers who were already on income-driven repayment (IDR) plans before the payment pause will witness their payments on undergraduate loans halved compared to other IDR plans. This measure ensures that borrowers’ balances do not increase as long as they meet the required payments.

SAVE incorporates adjustments based on borrowers’ family status and incomes. For instance, single borrowers earning less than $15 an hour or $32,805 annually will be exempt from making any payments. Borrowers with a family of four can earn up to $67,500 without owing any payments.

Married borrowers who file their taxes separately will no longer need to include their spouse’s income in their payment calculation for SAVE.

Additionally, their spouse will be excluded from their family size calculation when determining IDR payments, simplifying the repayment plan selection for borrowers.

Borrowers with incomes above these thresholds under Biden’s plan will save over $1,000 annually on their payments compared to other IDR plans.

READ ALSO: Democrats’ Fair Share Act To Extend Social Security, Medicare For Over 75 Years, Analysis Says

Biden’s Plan: New Benefits from SAVE Plan

Starting from July next year, the SAVE plan will introduce additional benefits, including:

- Borrowers will pay a weighted average of 5-10% of their income based on the original principal balances of their loans if they have both undergraduate and graduate loans.

- Borrowers whose original principal balance was $12,000 or less will qualify for forgiveness after 120 payments, equivalent to 10 repayment years. Up to a maximum of 20 or 25 years, an additional 12 payments will be required for every additional $1,000 borrowed beyond that threshold.

- Borrowers in default will have access to the existing income-based repayment (IBR) plan, enabling them to make lower payments and work toward forgiveness while they strive to exit default. Those in default who provide income information demonstrating a $0 payment at the time of default will automatically be reinstated to good standing, granting them access to the SAVE plan.

The full details of the SAVE plan can be found at: https://www2.ed.gov/policy/highered/reg/hearulemaking/2021/idrfactsheetfinal.pdf.

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)