Parents could once again see extra financial relief from the federal government if President Biden gets his wish.

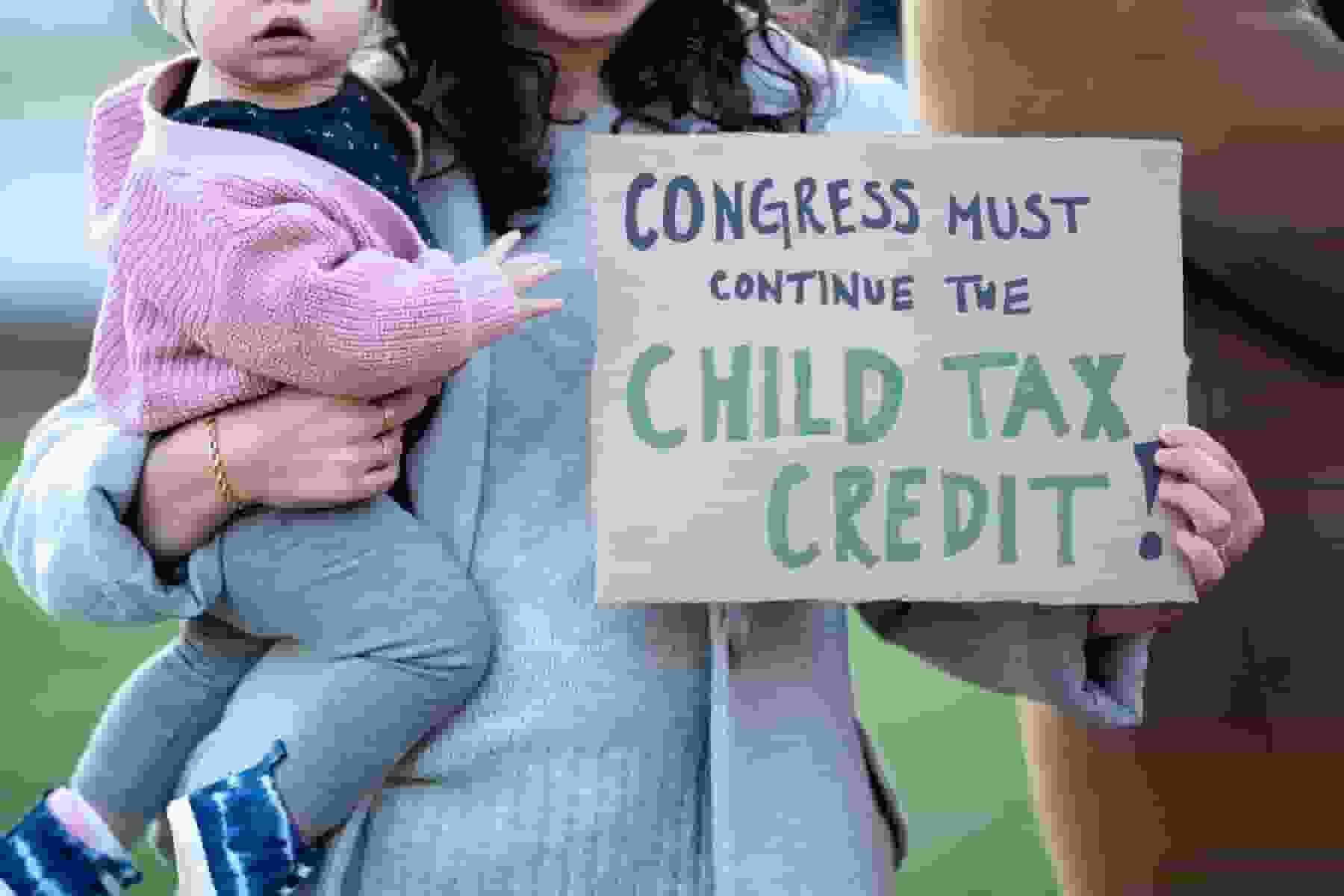

Biden’s proposal includes Enahanced Child Tax Credit. (Photo: The New York Times)

Recent Proposed Budget

In his recently proposed budget, he has included the reauthorization of the expanded Child Tax Credit that was included in the American Rescue Plan Act, according to a published article in The Motley Fool.

The Child Tax Credit provided parents of young children with a refundable tax credit of up to $3,600 (or $3,000 if their children were aged 6 to 17). The money was scheduled to be sent to parents at a rate of $250 or $300 per month.

Parents received the monthly payments from July to December of 2021 and were able to claim the other half of the money when filing their 2021 taxes in 2022. The president’s hope was that this credit would continue on an ongoing basis, but no bill has been passed since the American Rescue Plan Act was signed into law in March of 2021.

READ ALSO: Child Tax Credit 2023: Up To $3,900 Stimulus Checks— See Who Receives Them

Biden’s Tweet

In a recent tweet, Biden emphasized the importance of restoring the expanded Child Tax Credit, explaining how it cut child poverty in half and gave tens of millions of parents breathing room. “My budget would restore it,” he said.

If the credit is extended, parents or guardians of children could find themselves with hundreds of dollars more per month to assist them in covering expenses. The steady stream of government money could help adjust their budget accordingly.

While it remains to be seen if the president’s proposal will be made into law, there is some bipartisan support for offering extra help to parents. With this support, there is hope that this stimulus check will be back in some form in 2023 or beyond.

The proposed budget also includes other measures aimed at providing relief to families, such as universal pre-K, free community college, and paid family leave. These initiatives aim to support families and ensure that all Americans have the opportunity to thrive.

Biden’s budget proposal marks a renewed focus on supporting families in the wake of the COVID-19 pandemic. It remains to be seen if Congress will pass the proposed bill, but if it does, it could provide much-needed relief to families across the country.

READ ALSO: Child Tax Credit 2023: Up To $3,900 Stimulus Checks— See Who Receives Them

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)