Lisa Schwartz, a resident of Colorado, was furious upon discovering the charges on her American Express credit card statement.

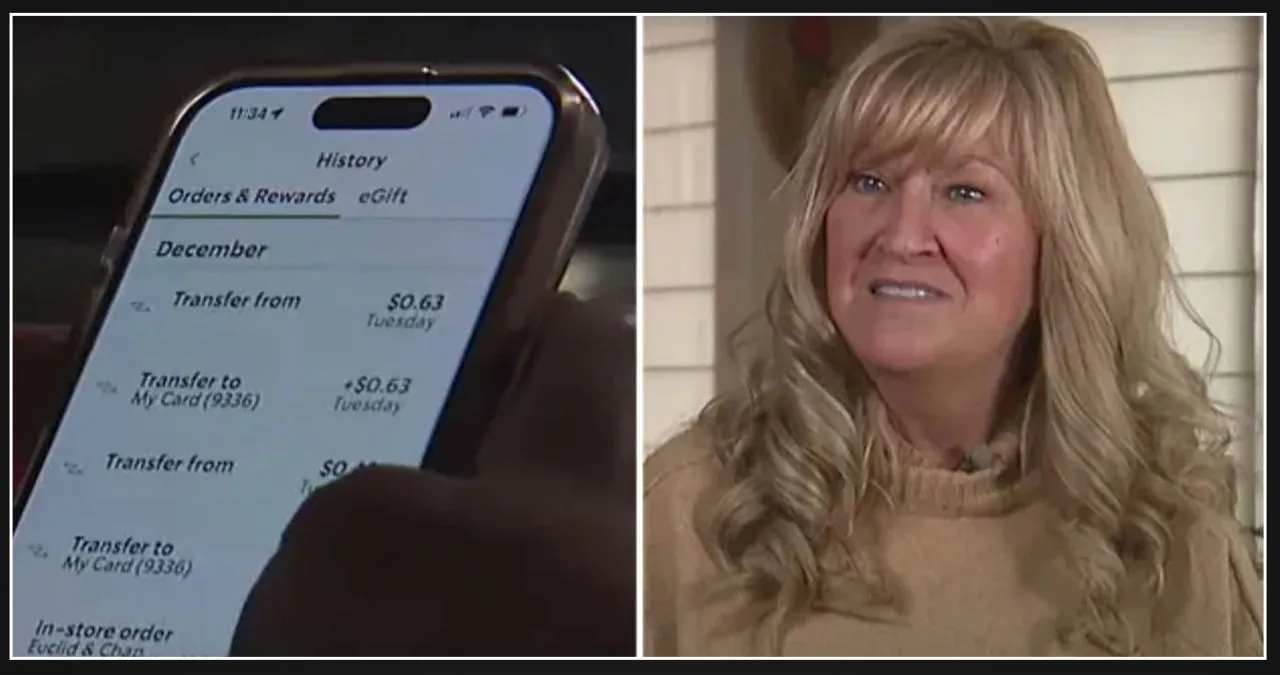

According to the Denver CBS affiliate KMGH-TV, Schwartz suspects that she was hacked when she discovered multiple transfers of funds to her Starbucks app on a daily basis.

Schwartz mentioned that she utilizes the auto-reload feature, which connects the coffeehouse’s app to her credit card.

Customers have the convenience of replenishing their accounts whenever their balance runs low. Schwartz made it possible for users to reload their accounts with $25.

As she reviewed her American Express bill, she discovered unexpected charges that amounted to “well over $2,000,” she stated.

The receipts, which were reviewed by the network, revealed purchases made at locations as distant as California.

Schwartz expressed a sense of unease, describing it as a sick feeling.

I was quite embarrassed for not being more diligent in keeping track of my bills.

“I don’t even drink coffee,” she mentioned, emphasizing her preference for a chai latte whenever she visits a Starbucks store.

Schwartz’s frustration has been increasing as she attempts to uncover the root of the problem.

According to her, she reached out to Starbucks, and a representative allegedly informed her that it was a banking problem.

However, the blame was shifted to Starbucks by an American Express representative.

The authorities are currently conducting an investigation, and Schwartz has mentioned that she received a temporary credit of $550.

The letter ended by expressing regret for any inconvenience the recipient may have experienced.

According to a cybersecurity expert interviewed by KMGH, Starbucks did not experience a breach. Instead, a malicious individual gained access to Schwartz’s login details.

If Schwartz were to use the same username or password for multiple websites, the hacker could potentially gain access to her other accounts, he cautioned.

After going through her traumatic experience, Schwartz issued a warning to everyone about the importance of closely monitoring the apps they use to input their credit card information.

PROTECT YOURSELF

When it comes to using apps to make purchases, security experts have shared some valuable tips on how users can safeguard themselves.

It is highly recommended for shoppers to use unique passwords for their accounts.

Creating strong passwords is typically achieved by using a combination of characters that are difficult to predict.

The paragraphs are quite long and lack any personal details.

According to cybersecurity expert Teresa Walsh from the Financial Services Information Sharing and Analysis Center, there are significant risks associated with using the same password.

According to Bankrate, if a cyber-criminal gains access to one compromised password, they could potentially have full access to all of your financial information.

According to her, guessing a 16-word password is more difficult for cybercriminals compared to an eight-character combination.

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)