According to the Internal Revenue Service, the agency intended to send letters to more than 9 million individuals and families who are qualified for various tax benefits but did not claim them by submitting a federal income tax return in 2021. Those in this category are able to claim some or all of the 2021 tax credits, depending on their personal and family circumstances. The IRS will send out these special reminder letters in the coming weeks.

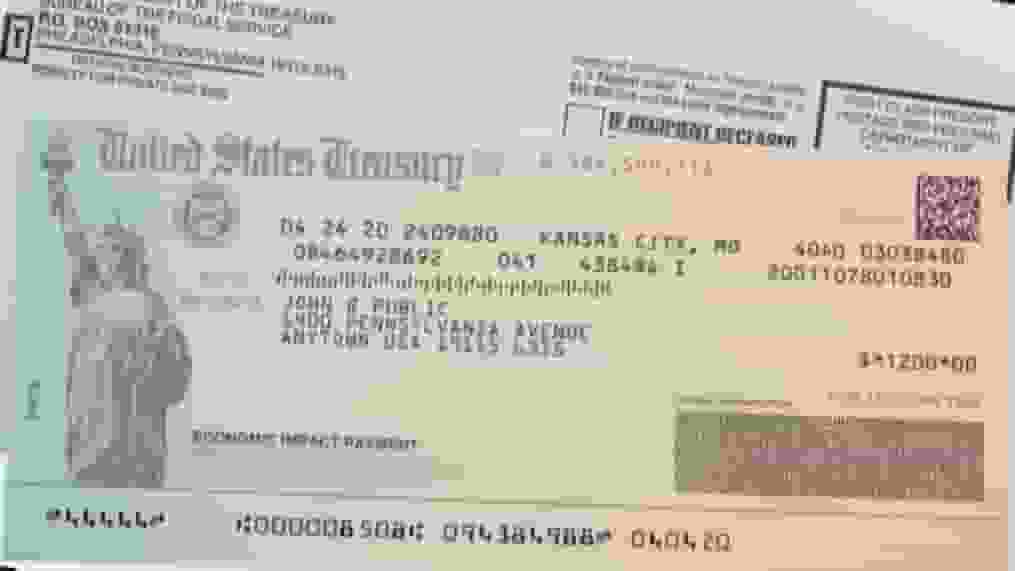

IRS announced that 9 million Americans received notifications for stimulus checks. (Photo: FOX)

In a statement, IRS Commissioner Chuck Rettig reminded potentially eligible people of the possibility of qualifying for the mentioned substantial tax credits. To get the stimulus payment, you must complete a tax return for 2021.

They may be entitled to considerable credits even if they are not obligated to submit. Individuals and families with low or no income are typically eligible for these additional tax breaks. The commissioner also stated that people will receive letters alerting them of their potential eligibility as well as the steps they can take.

Based on W-2 1099 forms and other third-party statements accessible to the IRS, Treasury’s Office of Tax Analysis identified persons who do not generally have a tax return filing requirement due to relatively low earnings. This is part of an ongoing effort to provide people with their due tax credits and refunds.

Possible qualified individuals can still file a tax return because there is no penalty for claiming a refund on a tax return filed after the ordinary April 2022 tax deadline. Filing an electronic return and selecting direct deposit is the quickest and easiest way to collect a refund.

Individuals with earnings under $12,500 and couples with incomes under $25,000 may be able to file a simplified tax return to claim the type of tax credits they require on the ChildTaxCredit.gov website.

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)