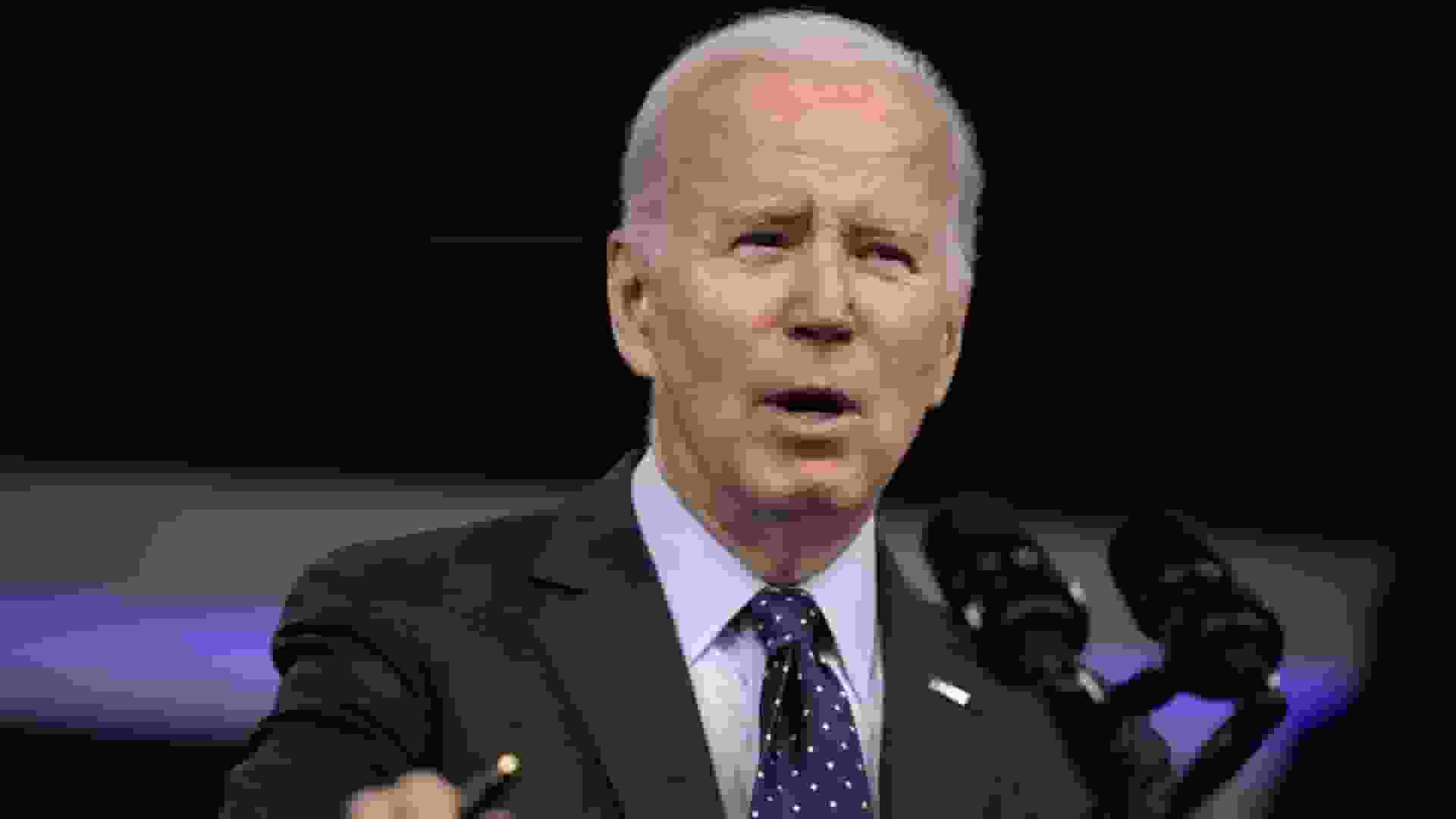

President Joe Biden has proposed raising taxes on wealthy Americans to help cover priorities such as Medicare and Social Security in his 2024 budget. According to a report by CNBC on March 9, 2023, the proposed plan includes a top marginal income tax rate of 39.6%, up from 37%, which would apply to single filers making over $400,000 and married couples with income over $450,000 per year.

Biden’s budget also aims to tax capital gains at the same rate as regular income for those earning more than $1 million and close the carried interest loophole, which allows wealthy investment fund managers to pay a lower tax rate than everyday workers, as reported by CNBC.

The plan is intended to reward work, not wealth, according to White House Office of Management and Budget Director Shalanda Young, who said the proposed tax increases are unlikely to pass in the Republican-controlled House of Representatives.

Based on a report by Kiplinger on March 10, 2023, Biden has also renewed his call for a minimum tax on the wealthiest Americans, including a 25% minimum tax on Americans with wealth exceeding $100 million. The president’s budget proposal aims to ensure that no billionaire pays a lower tax rate than a teacher or firefighter.

Biden’s proposed tax changes are designed to create a more equitable tax system and ensure that the wealthy pay their fair share to help cover priorities like Medicare and Social Security. The proposed tax changes will become a starting point for future negotiations and will align with Biden’s goal of creating a fairer tax system.

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)