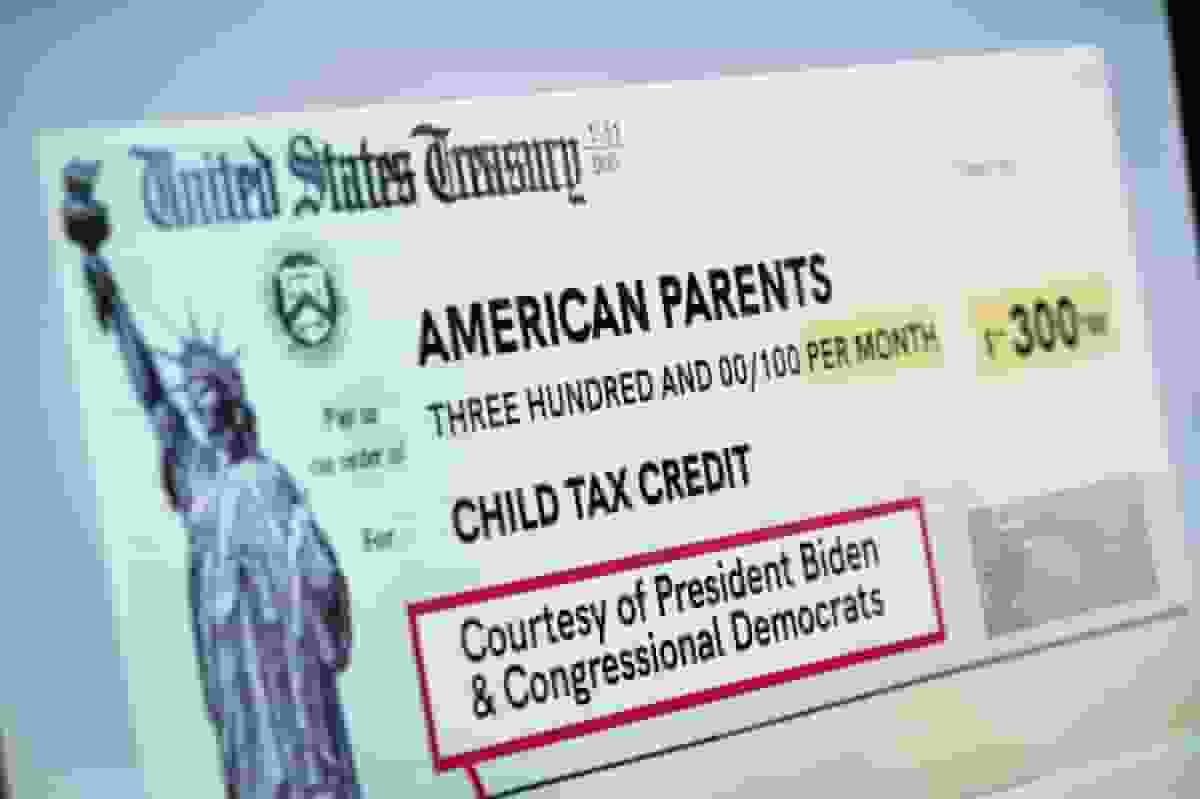

In 2021, House Democrats introduced a child tax credit bill based on a provision in President Biden’s American Rescue Plan. According to a report by CNN on February 8, 2022, the bill proposed a one-year benefit of up to $3,000 per child, with children under six receiving $3,600 and those aged six to 17 receiving $3,000. The benefit was available to single parents earning up to $75,000 and couples earning up to $150,000 annually, with payments phased out after those thresholds. The child tax credit at the time was up to $2,000 per child under 17.

The proposed bill aimed to make the child tax credit fully refundable by removing the $1,400 limit and the earnings requirement. Monthly payments were set to begin in July, and advocates believed that this would help families better meet their obligations compared to receiving a lump sum. The plan was expected to lift nearly 3 million children out of poverty, as reported by The New York Times on February 16, 2021.

Senator Mitt Romney also introduced the Family Security Act in 2021, which aimed to provide monthly cash benefits to families. The act proposed $350 per month for each young child and $250 per month for each school-aged child. Like the proposed child tax credit bill, the Family Security Act aimed to lift nearly 3 million children out of poverty. It also aimed to provide a bridge to the middle class without adding to the federal deficit.

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)