The Missouri Appeals Court ruled against St. Louis’s wage tax on remote workers prompting criticism from Rep. Jim Murphy.

Missouri Appeals Court Rules Against St. Louis Wage Tax on Remote Workers; Rep. Jim Murphy Criticizes City’s Appeal Expenses

The Missouri Court of Appeals unanimously ruled that the City of St. Louis broke state law by taxing wages of remote workers. Rep. Jim Murphy criticized the city for wasting taxpayer money on an appeal they were bound to lose.

The court rejected the lawsuit’s class-action status, potentially saving the city from hefty refunds. Murphy aims to prevent similar issues with new legislation. Last year, his efforts led to House Bill 1516, which would have stopped the city from taxing remote workers, according to the report of Washington Examiner.

READ ALSO: A New Lease On Life: Godalming’s Affordable Housing Solution For The Homeless

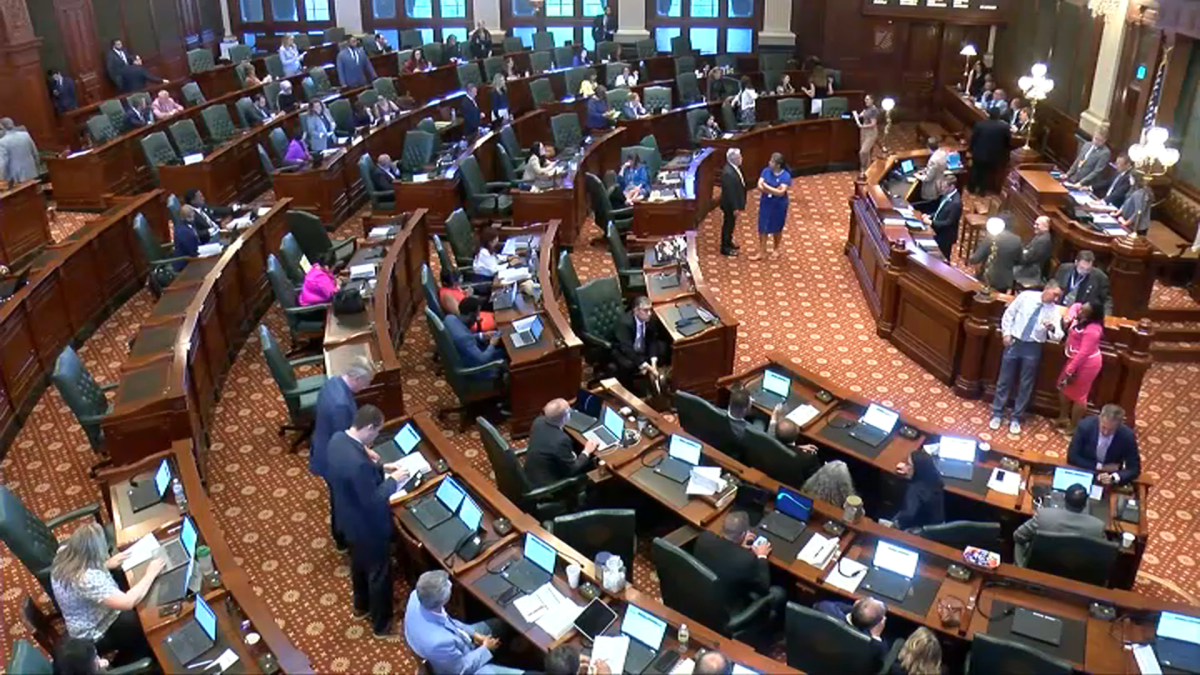

(photo: National Conference of State Legislatures)

Mayor Tishaura Jones Connects Hiring Freeze End to Failed Legislation on Remote Worker Taxation

Mayor Tishaura Jones linked the end of a hiring freeze to Murphy’s failed bill. Despite concerns about the city budget, officials believe the ruling won’t affect services or budgets.

The court examined language closely, even consulting a dictionary. Murphy praised Kansas City for refunding taxes from remote workers, contrasting St. Louis’s actions.

The court decision, a win for Missouri citizens didn’t compel the city to pay the taxpayers’ legal fees. Nevertheless, it highlights the debate over remote worker taxation and the need for legal adherence.

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)