Illinois Business Owners Brace for Potential Tax Changes Under Pritzker Budget Proposal

Concerns Mount Among Illinois Businesses Over Proposed Tax Increases in State Budget

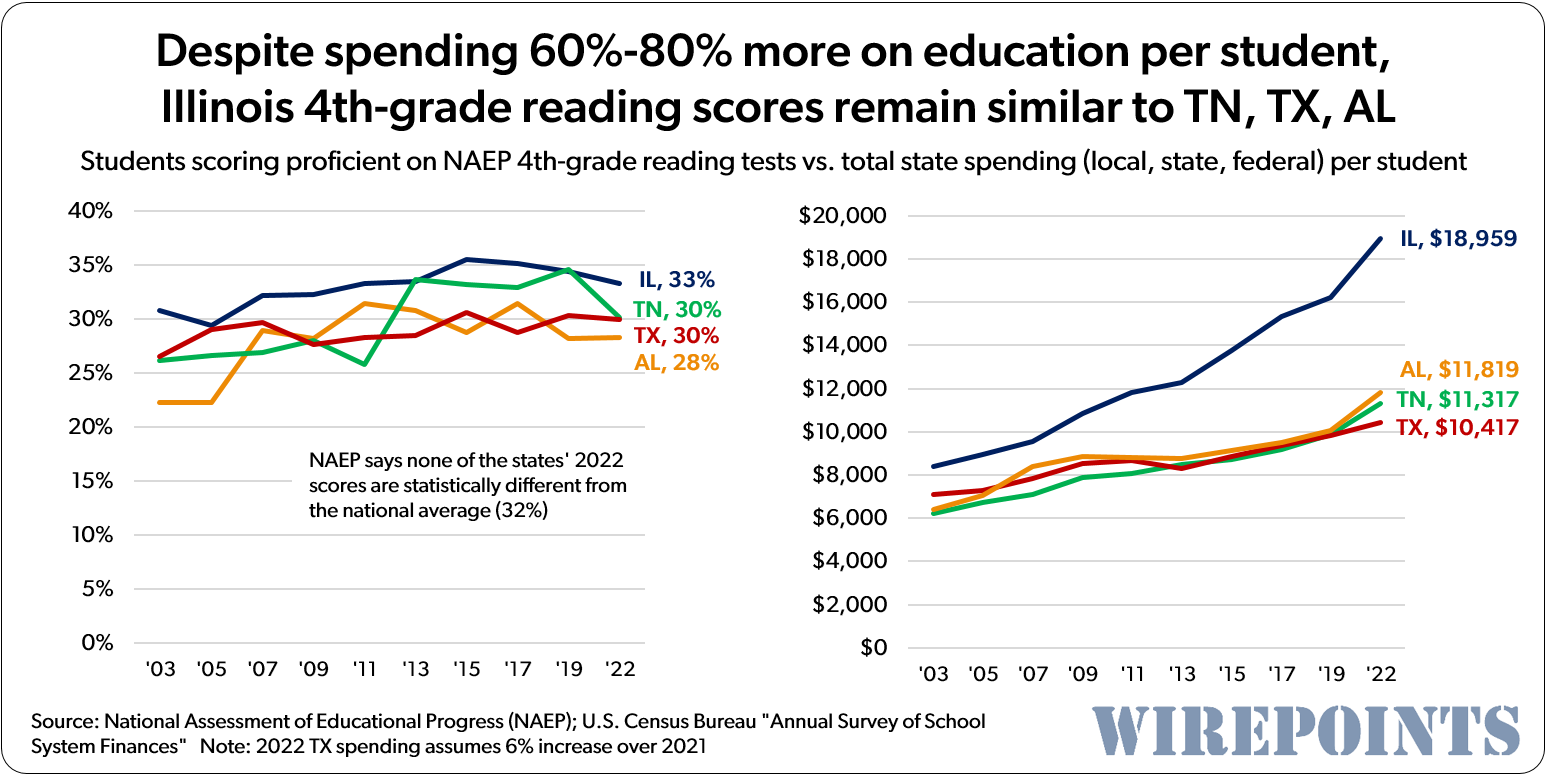

According to the report of Center Square, Illinois business owners are getting ready for possible tax changes as Governor J.B. Pritzker reveals his plan for the budget. He wants to raise the limit on how much businesses can deduct for losses to $500,000. This move could bring in about $526 million in extra money for the state part of nearly $900 million in total tax increases in his $52.7 billion budget. Illinois Chamber of Commerce boss Lou Sandoval worries this could feel like a tax hike for businesses hitting not just big companies but also smaller ones. He thinks it might make businesses hesitant to invest and grow in Illinois.

READ ALSO: $5,000 Caregiver Tax Credit Propelled In Statewide Initiative

Illinois Businesses Brace for $526M Tax Hit as Pritzker Budget Proposal Extends Net Loss Cap Warns Chamber of Commerce (PHOTO: Muddy River News)

Illinois Businesses Await Budget Decision’s Impact on Their Future

Sandoval words show that Illinois businesses are worried about how the budget could affect them. The new budget starts on July 1, and business owners are watching closely as lawmakers decide whether to approve it by May 31. The uncertainty about taxes and how they all affect businesses makes things tricky. As lawmakers meet again in Springfield the decision they make about the budget will shape the future of Illinois businesses and the state economy.

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)