The Colorado Department of Revenue gave more details about their online tool for an easier tax season for taxpayers.

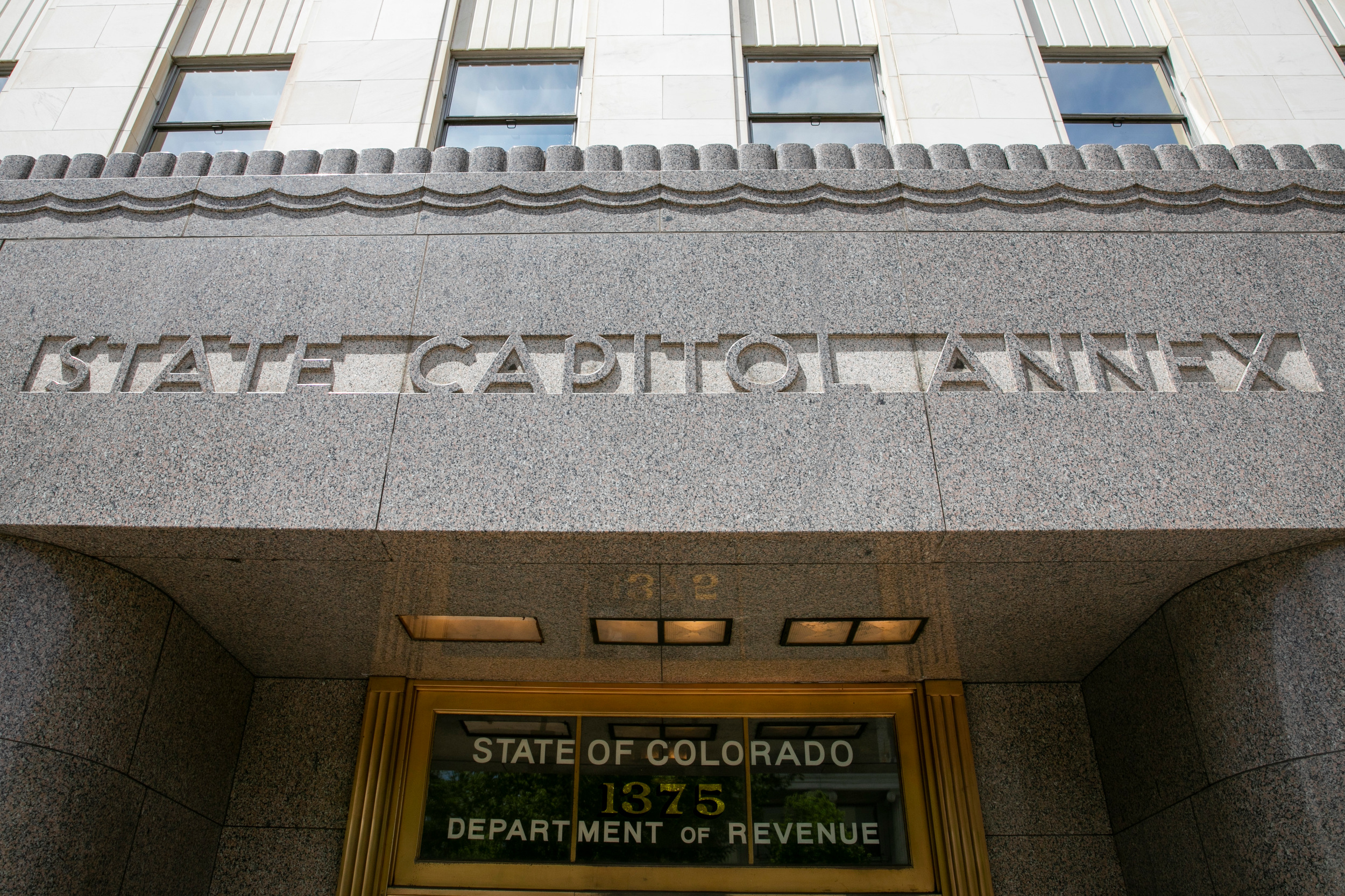

The Colorado Department of Revenue’s online tool will help taxpayers stay informed about their taxes. (Photo: CBS News)

Colorado Department of Revenue’s Online Tool

As the Colorado Department of Revenue announced, tax filers can track the status of their refund online. After submitting their tax return, Colorado residents can simply visit the Colorado Department of Revenue’s website and enter their social security number and the exact amount of their expected refund to check the progress.

This convenient online tool by the Colorado Department of Revenue allows filers to stay informed about when they can expect to receive their refund. Additionally, the Colorado Department of Revenue provides updates on any potential delays that may impact the processing time of refunds.

According to a published article by SmartNews, the Colorado Department of Revenue began processing 2023 tax returns on Feb. 12, but there may be delays in receiving refunds.

Filers can use a step-by-step guide on the Colorado Department of Revenue’s website to track their refund status. Remember, the tax deadline is April 15.

More About The Tax Returns In Colorado

In a published article by The Coloradoan, the Colorado Department of Revenue is processing tax returns for the 2023 tax year, leading to TABOR refunds. Single filers will receive $800, while married couples filing jointly will receive $1,600.

To get the TABOR refund in Colorado, you need to file a state tax return even if you don’t have to file federal taxes. You can e-file for free in Colorado.

READ ALSO: As 2023 Tax Season Has Begins, Here Are More Important Details About It!

![Tyson Foods Plant [Photo: Food Manufacturing]](https://southarkansassun.com/wp-content/uploads/2023/08/iStock_1185520857__1_.5e441daa51cca-600x337.jpg)

![Silverado Senior Living Management Inc. [Photo: Los Angeles Times]](https://southarkansassun.com/wp-content/uploads/2023/10/download-6-4-600x337.jpg)

![China's Wuhan Institute of Virology [Photo: Nature]](https://southarkansassun.com/wp-content/uploads/2023/09/d41586-021-01529-3_19239608-600x337.jpg)